According to scientists at non-profit organization First Street Foundation, flooding caused by rising sea levels has already caused a loss of $7.4 billion in home value across 5 states between 2005 and 2017.

Find out whether this change in climate affects you and what you can do about it.

Effects of Sea Level Rise

**Click to auto-scroll by section

How Rising Sea Levels Affect Coastal Property Value

In a peer-reviewed analysis conducted by Dr. Jeremy R. Porter and Head of Data Science at First Street Foundation, Steven A. McAlpine, it was found that $465 million in real estate market value was lost in Miami-Dade County alone.

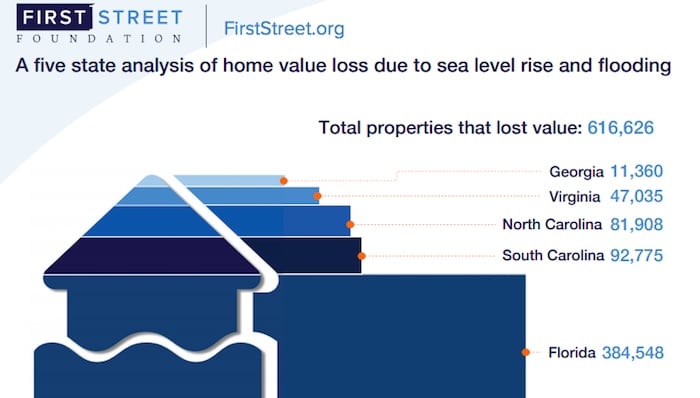

The study was expanded to include real estate transaction data from Florida, Virginia, Georgia, South Carolina, and North Carolina, showing that a total home value loss of $7.4 billion has occurred across these 5 states since 2005 due to flooding from rising sea levels.

Residents of the areas included in the study can use the interactive tool at FloodIQ.com to find information such as whether their community might be at risk, as well as projected flooding levels and potential property value depreciation amounts.

“Our research both confirmed that property lot flooding does impact homes, and additionally found that neighborhood flooding—which takes the proportion of nearby roads that flood into account—also contributes to slower appreciation of property value,” said Porter.

Scientists from First Street Foundation found that from 2005-2017, there was a total home value loss of $7.4 billion across 5 states.

Dr. Porter further explained, “We found that nearby road flooding actually accounts for two-thirds of the property value loss across the coastal area of Georgia, South Carolina, North Carolina, Virginia and the entire state of Florida,” which suggests that road flooding has more of an overall impact on property values than property lot flooding.

💡Take Note: This means that those living inland who experience flooding streets in their neighborhood will see a decrease in their property value, even if their property does not flood.

We know that previous studies have warned of the negative impact that climate change-related flooding could have on real estate value in the future, but this is the first published which shows that depreciation is already happening, and has been for some years now.

“We need to act now,” Porter added. “The ability to pay for solutions to sea level rise is directly related to our ability to finance them. We do not want to see the beginning of a domino effect, where lost property value lowers the tax base and cripples our ability to finance solutions.”

Need eco-friendly junk removal? BOOK A PICKUP ❯

The Impact of Rising Sea Levels on Inland Homes

The national sea level has risen 6.5 inches since 1950. However, nearly half of that increase was seen in only the last 20 years. While that may not seem like much, it has translated to a 200 – 400% increase in flooding throughout the United States in the last 2 decades.

In the past 5 years alone, the rise in sea level has accelerated at a rate 66% faster than the historical norm. On average, sea levels are now rising 1 inch every 5 years. While it took 60 years for the sea level to rise by around 5.5 inches (about the length of an iPhone), scientists now predict that in only the next 20 years, that number will have doubled.

Another analysis estimates that hundreds of coastal communities in the US will soon face chronic, disruptive flooding due to rising sea levels that will directly affect people’s homes, property values, and their very lives.

This study from the Union of Concerned Scientists found that long before rising sea levels permanently submerge properties, millions of Americans living in coastal communities will experience more frequent and disruptive flooding. They define this as “chronic inundation,” or flooding that occurs 26 times per year (about once every other week) or more.

View images of American cities with chronic flooding issues

Reaching this threshold will mean that regular routines become impossible and residents, communities, and businesses alike will be forced to make difficult and expensive decisions. This flooding is a result of increased height in high tides which reach further inland, all caused by rising sea levels.

The UCS study found that within the next 15 years, about 147,000 existing homes and 7,000 commercial properties which are currently worth a total of $63 billion are at risk of chronic inundation. With such a short time frame, these estimated 280,000 people living in those homes today will be forced to either relocate or find ways to adapt to regular flooding.

Homeowners and commercial property owners at risk of chronic inundation would start to see serious financial losses. In turn, these communities would experience a severe tax base erosion due to the decline in property values.

With the vanishing property taxes racing against the ever-increasing cost of regular flood response, funding for infrastructure and crucial local services (think roads, schools, and police) would quickly evaporate.

Several experts have warned that we would see a U.S. housing market crash worse than the 2007-2008 financial crisis, due to the devastation of coastal real estate values caused by rising sea levels and flooding. Many residents in these areas will not be able to pay for the repairs on their properties which could lead to banks foreclosing many properties.

Former head of the Federal Housing Administration, Edward Golding commented, “all of a sudden we’re going to reach a tipping point and no one will touch these mortgages. At some point it becomes undesirable risk and people start pulling out from entire regions.”

Green Junk Removal & Disposal BOOK ONLINE ❯

What Americans Can Do to Combat the Risks of Sea Level Rising

The thing is, it’s not like we haven’t been alerted to the problem, and we’ve had plenty of time to find a proactive solution. In 2016, Freddie Mac released an article warning that the housing market wasn’t prepared for the coastal real estate bubble burst rising seas would cause.

“We can see this coming and take steps to make sure it’s not a crash,” Rachel Cleetus, a UCS senior economist stated. “But we have to stop putting our heads in the sand and pretending this isn’t coming.”

There are certain measures that both current and potential homeowners in at-risk areas can take to protect themselves from falling property values due to the rise in sea levels.

Measures to take to combat rising sea levels in your area

- Know your community’s plan.

First Street Foundation’s executive director, Matthew Eby advises, “every homeowner that lives in a vulnerable area should contact their local elected official to understand the city’s plan to address sea level rise and flooding.”

Ask your city officials if there are any infrastructure projects planned to prevent flooding. If not, find out whether the city would consider implementing such measures. Connect with groups in your community that might be interested in spearheading such efforts.

- Explore options for adaptation modifications.

There are ways to protect the value of your home or commercial property without drastic alterations, such as installing a flood vent or even raising the physical structure.

If you own your home, you may want to consider raising the electric meter, HVAC system, and plumbing when flooding occurs. Keep your gutters, downspouts, and drains cleared. Eby also suggests adding rain gardens to landscaping or swapping out concrete for alternative pavement materials that are better at draining rainwater.

- Consider future risks.

Though many properties currently have minimal risks, they could become more susceptible to flooding as sea levels continue to rise, warns Eby. The UCS estimates that over 300,000 of today’s coastal homes, with a current collective market value of about $117.5 billion, are at risk of chronic inundation in 2045.

- Find ways to reduce flood insurance premiums.

“If a community is not part of the NFIP’s (National Flood Insurance Program) Community Rating System, they should join,” says Eby. If your community is already a member, you can petition your local officials to seek out proactive flood insurance programs that will protect residents and improve the community’s NFIP scores.

❗Did you know? Improving a community’s NFIP scores can reduce flood insurance premiums for all residents by up to 45%.

Businesses, communities, states, and the federal government all need to take action, given the enormity of the local and national risks presented by rising sea levels.

Sea levels continue to rise, and the risks are sincere. While there may be no easy fix and many of the risks are inevitable at this point, there are still opportunities to limit the damage that lies in front of us. But our time to take action is quickly fading.

Eby’s advice? “The best way to preserve home values is to take personal preventative measures and demand your city do the same.”

Related Articles from the Trash Talk Blog:

Junk Removal Made Easy

- Guaranteed upfront pricing online.

- No on-site haggling or surprise fees.

- Payments handled securely online.

- Million dollar premium insurance.

- Eco-friendly removal & disposal.